Starting a limited liability company (LLC) is foundational to you starting a business, winning grants, and securing the financial future of you and your family.

In this blog post, I’ll explain step by step how to set up a single-member LLC. I'll cover everything from understanding what an LLC is to filling out the required paperwork.

By the end of this post, you'll know how to:

- Choose a name for your LLC

- Decide where to set up your LLC

- Register your LLC with the government

- Get any needed licenses

- Set up a bank account for your business

- Handle ongoing paperwork

My goal is to help you start your LLC with confidence. This isn't just about starting a business - it's about creating new opportunities for you and your family.

What is a Single Member LLC?

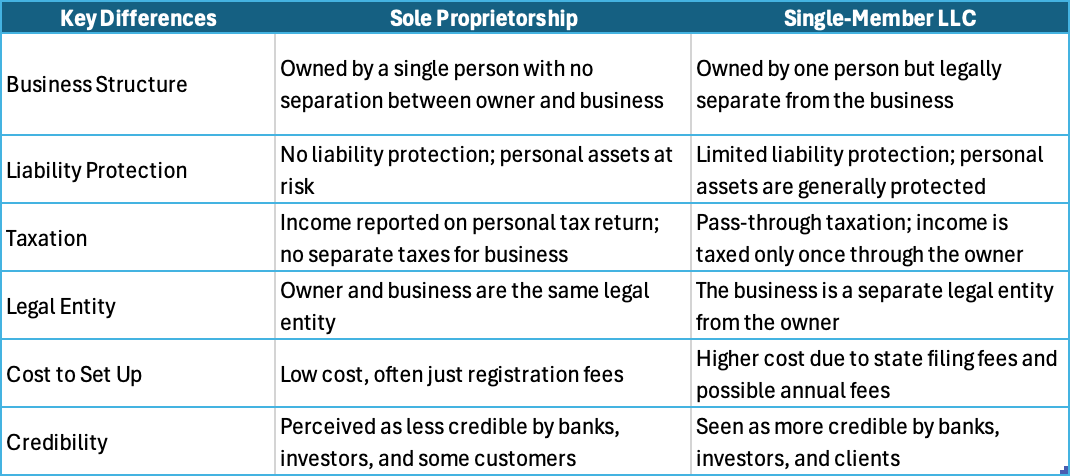

So, why choose a single-member LLC over just sticking with a sole proprietorship? The key benefit lies in the legal separation between you (the owner) and the business itself. With a sole proprietorship, your personal and business assets are legally tied together. If something goes wrong in the business—say, a lawsuit or financial trouble—you’re personally on the hook. Your savings, home, or other personal assets could be at risk.

However, with a single-member LLC, this dynamic changes. Your business becomes a separate legal entity. This means that your personal assets (such as your home, car, and bank accounts) are typically protected from business liabilities. In the event of a lawsuit or bankruptcy, only the assets owned by the LLC are vulnerable, shielding your personal finances.

Another great feature of a single-member LLC is the simplicity in taxes. You can opt for "pass-through" taxation, meaning that your business income is treated just like personal income. You won’t face the double taxation that corporations do. However, you still benefit from the formal structure that can make your business appear more credible to banks, investors, and clients.

In short, a single-member LLC gives you the best of both worlds: the simplicity of managing your own business while enjoying peace of mind knowing your personal assets are safeguarded. Check out the chart below for a breakdown of key differences.

Key Steps to Set Up a Single Member LLC

1. Choose a Unique Name

2. Choose Your State of Formation

However, if your business operates across multiple states or you have specific legal or privacy concerns, you might benefit from forming your LLC in a state with more favorable laws like Wyoming. It’s essential to consider these factors carefully to ensure that your LLC provides the intended benefits and aligns with your business goals.

Additionally, when choosing your state of formation, it's important to think about privacy. The business address you use for your LLC will be public record, which could potentially compromise your privacy if you use your home address. To avoid this, consider setting up a virtual office. This provides you with a professional business address while keeping your personal information protected and separate from your business dealings

3. Choose A Registered Agent

Selecting a registered agent is an essential step in forming your LLC. A registered agent is a designated person or business entity responsible for receiving legal documents, such as tax notices or lawsuits, on behalf of your LLC. They must have a physical address in the state where your LLC is formed and be available during normal business hours. This ensures your business stays compliant with state regulations and doesn't miss any important notifications. For business owners who value privacy, a registered agent can help keep personal addresses off public records.

A business formation service like Tailor Brands can act as your registered agent, managing legal paperwork and ensuring you never miss critical documents. This allows you to focus on running your business while staying compliant and maintaining your privacy.

4. Register Your Single Member LLC

They specialize in assisting new business owners by filing the required paperwork with the state on your behalf and handling the administrative details. Tailor Brands has helped over 300,000 business owners legitimize their businesses by setting up their business entities with their respective states, taking the hassle out of forming your LLC.

6. Create an Operating Agreement

Here are the key details an operating agreement should include:

- Ownership Structure: Clearly define that you are the sole owner of the LLC and outline any potential for adding new members in the future.

- Management Responsibilities: Detail how the business will be managed, including your role as the sole member and how decisions will be made (whether you will manage it yourself or appoint a manager).

- Profit and Loss Allocation: Specify how profits and losses will be distributed, even if all earnings go directly to you as the sole member.

- Bank Accounts and Financial Procedures: Outline how business finances will be handled, including opening bank accounts, maintaining financial records, and paying expenses.

- Business Operations: Provide guidelines on day-to-day operations, decision-making processes, and how key business activities will be conducted.

- Asset Protection: Reinforce the separation between your personal and business assets to protect your personal liability in case of legal issues or business debts.

- Dissolution Procedures: Outline what happens if you decide to dissolve the business, including how remaining assets will be distributed and debts settled.

- Amendments to the Agreement: Specify how changes or updates to the operating agreement will be handled in the future.

- Succession Planning: Include provisions for what happens to the LLC if you are no longer able to manage it, whether due to death, disability, or other reasons.

By having a detailed operating agreement, you create clarity and protection for both you and your business.

7. Obtain an EIN (Employer Identification Number)

5. Obtain Licenses and Permits

At the federal level, certain businesses may need to apply for licenses from agencies like the Environmental Protection Agency (EPA) or the Alcohol and Tobacco Tax and Trade Bureau (TTB). You should also check with your state and local government to identify any additional permits required for your business to operate legally. For detailed information, you can visit the Small Business Administration.

Navigating these requirements can be overwhelming, but Tailor Brands can help by guiding you through the process of identifying and applying for the right licenses and permits. By ensuring you have the proper approvals in place, you can avoid costly penalties and keep your business running smoothly.

8. Set Up a Separate Business Bank Account

Remember to bring your LLC formation documents, EIN, and any other required documentation when opening a business bank account. Having this account makes it easier to track income and expenses, manage cash flow, and pay taxes.

8. Comply with Ongoing Requirements

In addition, starting in 2024, the Corporate Transparency Act will require most LLCs, including single-member LLCs, to submit a Beneficial Ownership Information (BOI) report to the Financial Crimes Enforcement Network (FinCEN). This report discloses the names of individuals who have significant ownership or control over the business.

Staying informed about these ongoing state and federal requirements is essential to avoid penalties or legal complications. By remaining compliant, you'll ensure that your LLC remains in good standing and continues to provide the legal protections you established it for.

By following these key steps, you will have successfully set up your single-member LLC and paved the way for a legally protected and thriving business. Remember, seeking professional guidance from an attorney or business formation company can provide valuable insights and ensure that you navigate the process smoothly.

Conclusion

Forming a single-member LLC can provide numerous advantages, such as separating your personal and business assets, gaining limited liability protection, and enjoying flexibility in taxes. These benefits can significantly contribute to the long-term success of your business.

Remember, as a business owner in the United States, it's crucial to have a solid legal foundation. The single-member LLC structure offers a straightforward and effective approach to achieving this. With the right approach and diligence in fulfilling the requirements, you can pave the way for a profitable business.